Investment Banking Jobs is at the heart of finance, linking companies with capital for growth. It’s crucial for the global economy, helping companies expand. The U.S. Bureau of Labor Statistics says the field will grow 7% from 2022 to 2032, faster than most jobs.

About 40,100 new jobs will open each year, mainly because of retirements and career changes. People in this field can earn between $100,000 and $200,000, making it a high-paying job in finance.

Key Takeaways

- The investment banking industry is projected to grow faster than the overall job market, with 7% growth from 2022 to 2032.

- Approximately 40,100 investment banking job openings are expected annually, driven by workforce transitions and retirements.

- Investment banking salaries can range from $100,000 to $200,000, offering competitive compensation in the finance sector.

- Investment banking provides a dynamic career path, connecting companies with capital to fuel growth and innovation.

- The industry’s global reach and diverse opportunities appeal to professionals at all career stages, from recent graduates to experienced leaders.

Current State of Investment Banking Career Opportunities

The investment banking job market is looking good, with steady growth and lots of chances ahead. The demand for roles in capital markets and M&A advisory is high. This shows the finance sector’s strength and adaptability.

Growth Projections and Industry Trends

Experts predict a big increase in investment banking jobs. This is because financial markets are getting more complex. Also, there’s a growing need for expert advice in areas like mergers and acquisitions.

Key Market Indicators for 2024

Several signs suggest a bright future for job seekers in investment banking. New York is the main hub, with 21.1% of all jobs in the U.S. Business degrees are also key, needed in 90.9% of job ads.

Regional Distribution of Opportunities

New York leads, but London, Hong Kong, and Singapore are also booming. Job seekers should watch these areas for the best chances in capital markets or M&A.

Despite strong growth, remote work is rare, with only 3.5% of jobs offering it. This highlights the need to be ready for fast-paced, collaborative office work.

Essential Skills and Qualifications for Investment Banking Jobs

If you want a career in corporate finance jobs or investment management careers, you need the right skills. Investment banking is tough, and employers look for a mix of technical skills and soft skills.

At the heart of investment banking is knowing how to do financial modeling and analysis. Excel is key for making complex models, analyzing data, and valuing things. Knowing PowerPoint well is also important for making great presentations.

Investment banks also value good communication and client skills. Being able to explain complex finance in simple terms is important. Skills like paying attention to detail, solving problems, and working well with others are also key.

To do well in investment banking, you need to understand accounting, how to value things, and predict finances. Knowing tools like Power BI, PitchBook, and Bloomberg Terminal helps too.

Getting certifications like the Chartered Financial Analyst (CFA) or passing the FINRA Series 7 and 66 exams can help. While a degree in a quantitative field is good, knowing finance and accounting well is more important.

Investment banking is tough, but with the right skills and a proactive attitude, you can succeed. Keep improving your skills and stay up-to-date with trends to open doors in corporate finance jobs and investment management careers.

“In investment banking, attention to detail is paramount. You need to be able to analyze vast amounts of data, spot trends, and provide actionable insights to clients.”

Remember, investment banking is competitive. But by building a strong skillset and keeping learning, you can be a valuable asset to any company.

Top Investment Banking Employers and Work Environment

The investment banking world is filled with top global firms. Each offers different work settings and career paths. JPMorgan Chase & Co. leads with 24.8% of job postings. Morgan Stanley, Sumitomo Mitsui Banking Corporation, Goldman Sachs, and Jefferies & Company, Inc. also rank high.

Leading Global Investment Banks

Goldman Sachs, founded in 1869, is a leading name in investment banking. It’s known for being a top place to work. Credit Suisse, with over 250 branches in Switzerland, is a major player in Europe.

J.P. Morgan Chase is famous for its training program. It helps new employees grow and build lasting careers. This shows the firm’s dedication to employee growth.

Office Culture and Work Settings

Most jobs in investment banking are full-time, with 75.4% of roles. This shows the industry’s focus on in-person work. Yet, 3.53% of jobs offer remote work, meeting the needs of today’s workers.

Remote Work Opportunities

Investment banking is moving towards more flexible work options. Firms like Bank of America Merrill Lynch now offer remote work. This helps employees balance work and personal life while staying productive.

| Investment Bank | Ranking (Vault 2024) | Key Strengths |

|---|---|---|

| Centerview Partners | 1st | Prestigious Mergers and Acquisitions, Collaborative Culture |

| Evercore | 2nd | High-Profile Deals, Attractive Perks (free breakfast) |

| Goldman Sachs | 3rd | Enduring Reputation, Structured Career Development |

| Credit Suisse | 4th | Global Presence, Extensive Employment Opportunities |

| J.P. Morgan Chase | 5th | Training Program, Commitment to Employee Growth |

The investment banking world offers many top employers. Each has its own unique work environment and career paths. Whether it’s the big deals at Centerview Partners or the perks at Evercore, there are many options for those looking for securities trading jobs or private equity roles.

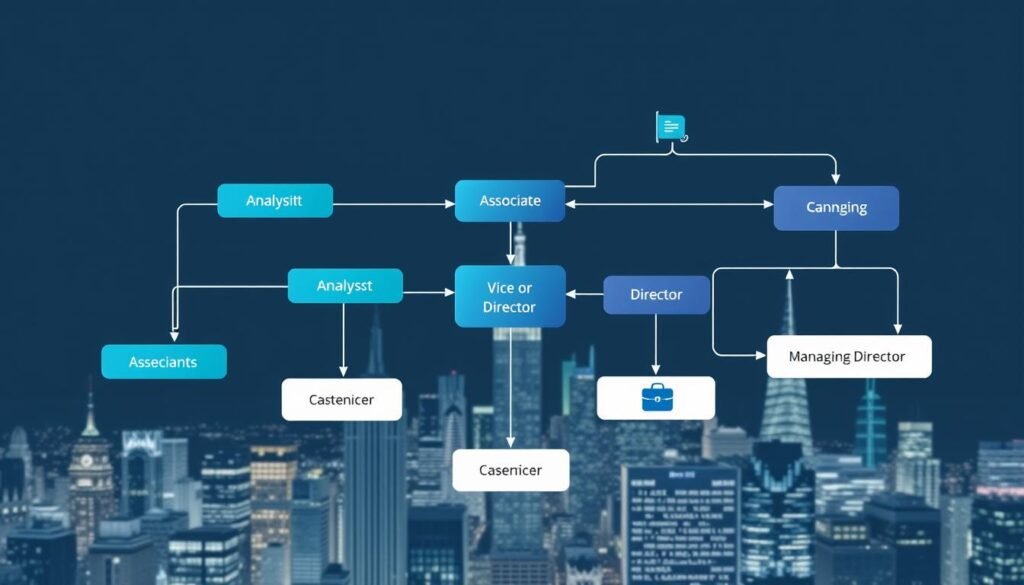

Career Paths and Advancement Opportunities

The finance world has many career paths and chances for growth, especially in investment banking. If you’re starting out or looking to advance in wealth management or finance, investment banks offer great opportunities. They help you grow and develop in your career.

Morgan Stanley is dedicated to helping its employees grow. They support you from the beginning as an analyst to the top as a managing director. They offer guidance and support at every step of your career.

Typically, you start as an analyst and move up to associate, vice president, and then director. Each step means more responsibility and higher pay. Managing directors can earn up to $1.3 million or more.

Investment banking also has many other career paths. You can work in financial advisory, research, or even technology. This variety lets you choose a career that fits your skills and interests.

Morgan Stanley values diversity and inclusion. They believe a diverse team is key to their success. This makes them a top choice for those looking to succeed in finance.

| Investment Banking Role | Typical Salary Range |

|---|---|

| Analyst | $100,000 – $125,000 |

| Associate | $175,000 – $225,000 |

| Vice President | $250,000 – $300,000 |

| Director/Senior Vice President | $300,000 – $350,000 |

| Managing Director | $400,000 – $600,000+ |

If you’re interested in wealth management careers or finance careers, investment banking is a great choice. Morgan Stanley and others offer support and celebrate diversity. They help ambitious people reach their goals.

Technical Skills and Financial Modeling Requirements

If you’re looking into investment banking jobs or wall street opportunities, you’ll need to master certain skills. These skills are key to doing well in this fast-paced field.

Excel and Financial Software Proficiency

Investment bankers use spreadsheets a lot, and Excel is a big part of that. Knowing how to use Excel’s advanced features is very important. It’s also good to know other financial software, like Bloomberg and Thomson Reuters.

Valuation and Analysis Tools

Being good at financial analysis is crucial in investment banking. You’ll need skills in discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and more. These tools help you understand a company’s financial health, which is key for making smart investment choices.

Data Management Skills

Investment bankers work with big data sets. Being able to manage and analyze this data is very important. Knowing how to use software like Microsoft Access can make you more valuable. Also, being able to present complex data in a clear way, using tools like PowerPoint, is a big plus.

By improving your technical skills and financial modeling, you’ll stand out in the world of investment banking jobs and wall street opportunities.

“Financial modeling skills are considered a major requirement for roles in investment banking.”

Compensation and Benefits in Investment Banking

Investment banking offers top-notch pay that matches the job’s demands and the skills needed. Knowing about pay is key for planning your career in finance.

Salaries in investment banking start at $100,000 and can go up to $200,000. As you move up, you can earn even more. Pay usually includes a base salary and bonuses based on performance.

| Role | Base Salary | Total Compensation | Age Range |

|---|---|---|---|

| Analyst | $100,000 – $125,000 | $140,000 – $190,000 | 22-27 years old |

| Associate | $175,000 – $225,000 | $225,000 – $425,000 | 25-35 years old |

| Vice President | $250,000 – $300,000 | $450,000 – $650,000 | 28-40 years old |

| Director/Senior Vice President | $300,000 – $350,000 | $550,000 – $750,000 | 32-45 years old |

| Managing Director | $400,000 – $600,000 | $600,000 – $1,300,000+ | 35-50 years old |

Investment banking also offers great benefits. These include health insurance, retirement plans, and paid time off. The high pay shows the job’s challenges and the chance for career growth.

Keep in mind, pay can change based on the bank, location, and your experience. Knowing about pay helps you choose the right investment banking jobs and finance careers.

Breaking Into Investment Banking: Entry Points and Requirements

Starting a career in investment banking is tough. It doesn’t matter if you’re new to the job market or looking to change careers. Knowing the best ways to get into investment banking is key. Let’s look at the main paths to enter this field.

Educational Prerequisites

To get into investment banking, you need a solid education. Degrees in business, finance, economics, or accounting are most wanted. Having a high GPA, like 3.7 or higher, can really help you get noticed.

Internship Opportunities

Internships are a big step towards investment banking jobs. Big companies like Morgan Stanley have great programs for students and new grads. But, with so many applying, it’s very competitive.

Networking Strategies

Networking is crucial in investment banking. Meeting people in the field, going to events, and using your contacts can help a lot. About 95% of people say networking is key to getting hired.

To succeed in investment banking, you need good grades, internship experience, and networking skills. With these, you can make a strong start in this exciting field.

Conclusion

The investment banking world is always changing, offering exciting careers for finance experts. As the financial scene shifts, being able to adapt and keep learning is key. This is true for investment banking jobs and finance careers on Wall Street.

Investment banking values technical skills, diversity, and global chances. It’s a field that offers growth and chances to move up. Despite its challenges, the need for skilled and flexible workers is still high. This is shown by the good pay and chances for advancement.

If you’re beginning your investment banking jobs journey or aiming to advance in your finance careers, this article has useful insights. It can guide you through the fast-paced world of investment banking. And help you reach your highest potential on Wall Street.